For residency programs, the start of fall isn’t marked by the arrival of pumpkin spice, or yellow and orange leaves falling from cerulean skies above, or even the fall equinox. Fall arrives when the Electronic Residency Application Service (ERAS) opens, signifying the start of another residency recruitment cycle.

Among my personal favorite fall traditions is reviewing the first round of ERAS preliminary data. This year, the AAMC made us wait almost till the end of October before their first public data drop, but when it arrived, I wanted to savor it just like a crisp autumn morning.

So you know what that means.

Yup, that’s right. It’s time to break it down, Winners & Losers™️ style.

–

–

LOSER: Application Fever.

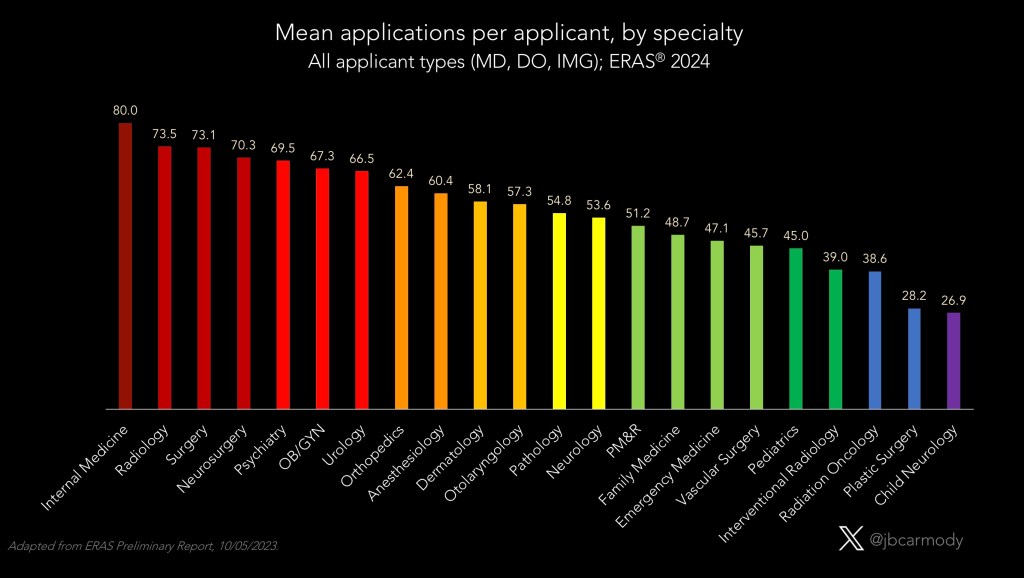

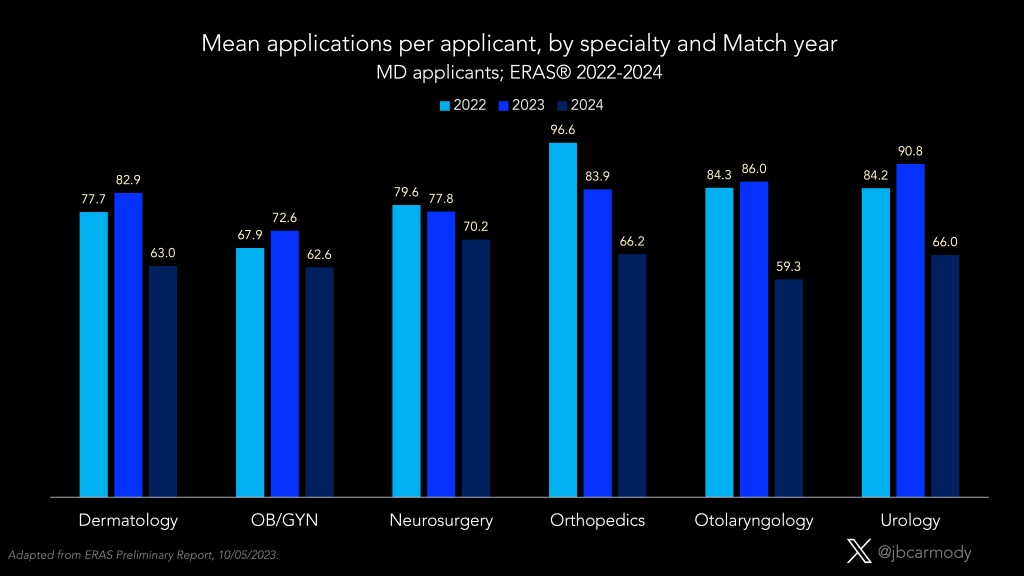

Typically, the big story from each year’s first ERAS data release is some version of “What incredibly-high number of programs are applicants applying to this year?” And look, applicants are still applying to a ton of programs… but in many specialties, the mean number of applications-per-applicant is down.

The chart above includes applicants of all educational backgrounds, but there are important differences in specialty preference and application strategy among U.S. MDs, DOs, and international medical graduates (IMGs).

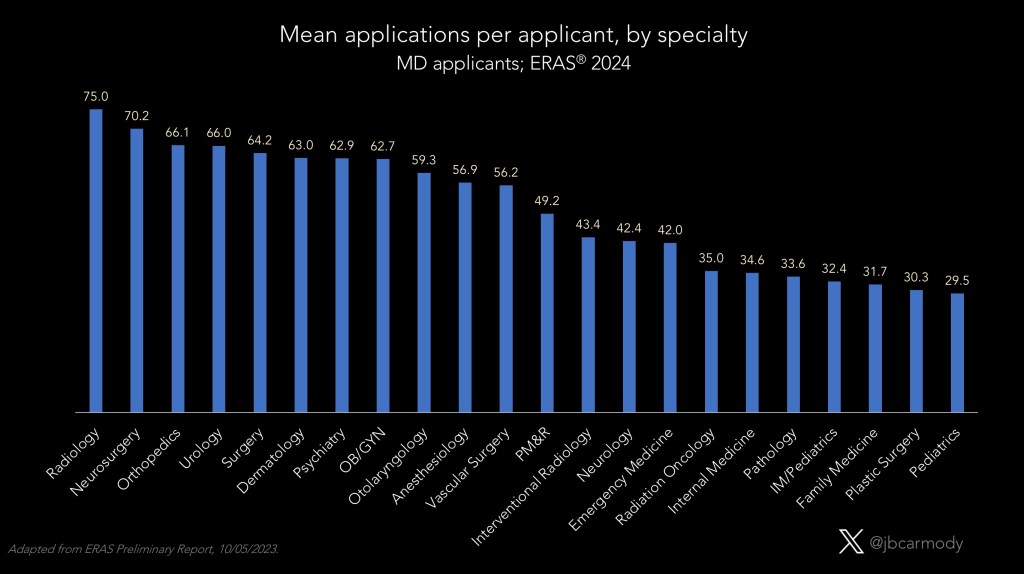

Among U.S. MDs, diagnostic radiology applicants now submit more applications on average than applicants targeting any other specialty.

But the mean number of applications submitted by aspiring radiologists this year (75) is virtually identical to this time last year (74.2). However, last year the average MD dermatology applicant submitted a mean of 91.6 applications apiece, followed closely by urology (90.8), otolaryngology (86), orthopedics (83.9), and neurosurgery (77.8). Notice how much those blue bars have shrunk on the graphic above.

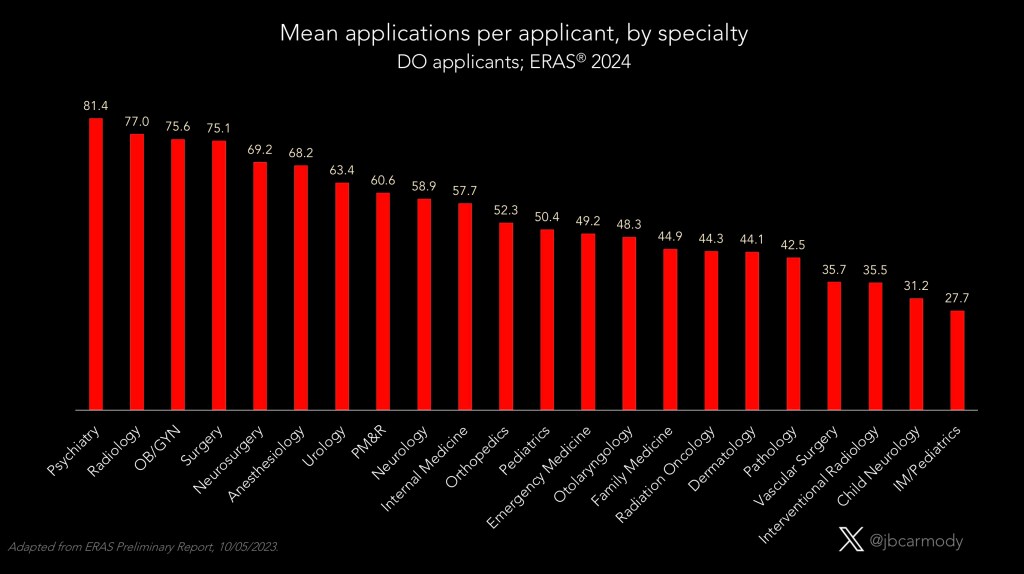

Meanwhile, among DO applicants, psychiatry is now king with 81.4 applications apiece.

But again, that’s stable from last year (80), and the other specialties previously at the top of the DO list have seen a drop in applications per applicant (diagnostic radiology at 88.4–>77, OB-GYN from 85.2–>75.6, anesthesiology from 81–>68.2).

For IMGs, internal medicine and general surgery were #1 and #2 last year. Unsurprisingly, they are again this year, too.

But in contrast to the MD and DO data, IMG applications-per-applicant for medicine and surgery programs are both up slightly from last year (110.2–>115.6 for IM, 83.4–>85.9 for general surgery).

What gives? Why are applications in some specialties up slightly or unchanged – but others are down significantly?

Let’s dig a little deeper.

–

WINNER: Big signaling.

In 2020, otolaryngology residency programs changed residency selection – maybe forever – by introducing formal preference signaling. Otolaryngology applicants were given 5 tokens to assign to the programs that they were really interested in, and programs that received these tokens had an incentive to review those applications very closely.

But last year, orthopedic surgery and OB-GYN programs changed preference signaling – almost certainly forever – by giving applicants a large number of signals (18 for OB-GYN, 30 for orthopedics).

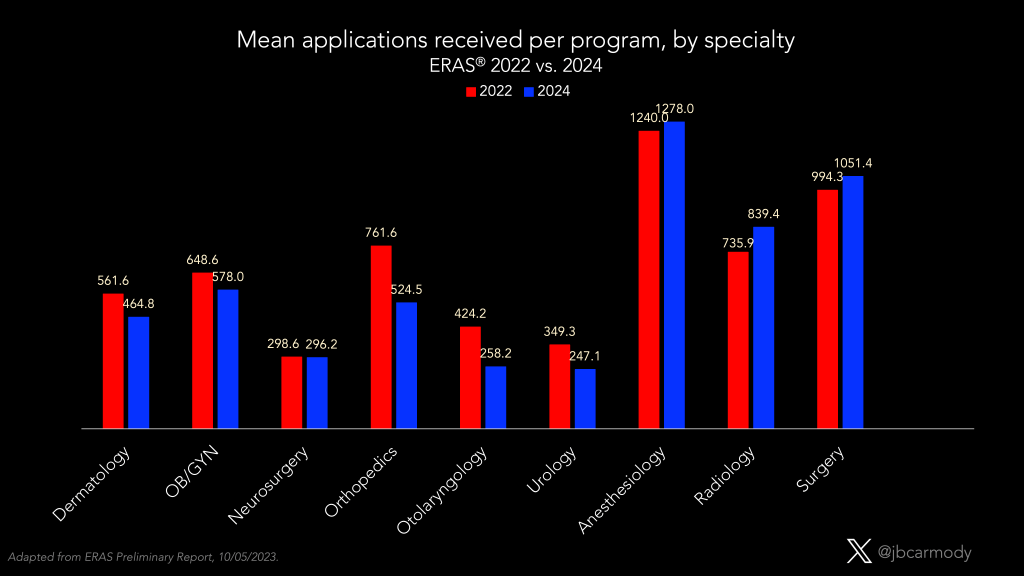

This Big Signaling changed the calculus for programs.

Now, the lack of a signal became more informative to program directors than the presence of one – since anyone who didn’t signal could be credibly ruled out.

Programs don’t have the luxury of interviewing 30 applicants for every position they’re trying to fill. And if an applicant didn’t signal your orthopedic surgery program, you know you were – at best – 31st on that applicant’s preference list. Why waste your time trying to convince them otherwise? Why chase birds in the bush when there are so many highly qualified birds sitting right there in your your hand?

It only took a year for applicants to wise up – and start saving their money.

Most specialties that have moved to Big Signaling have seen a significant decrease in the number of applications received.

I don’t think there’s any turning back from Big Signaling.

My strong suspicion is that the specialties currently using a more modest number of signals will embrace Big Signaling in future application cycles. Meanwhile, as applicants become convinced by data demonstrating the low yield of non-signaled applications, they’ll stop applying to programs in excess of their signal limit.

The residency selection arms race will continue on… but the focus of the competition will shift from Application Fever to a new high-stakes meta-game in which the key operation for applicants is deciding where to signal.

(Hold that thought… I’ll come back to it in a moment.)

–

LOSER: The AAMC.

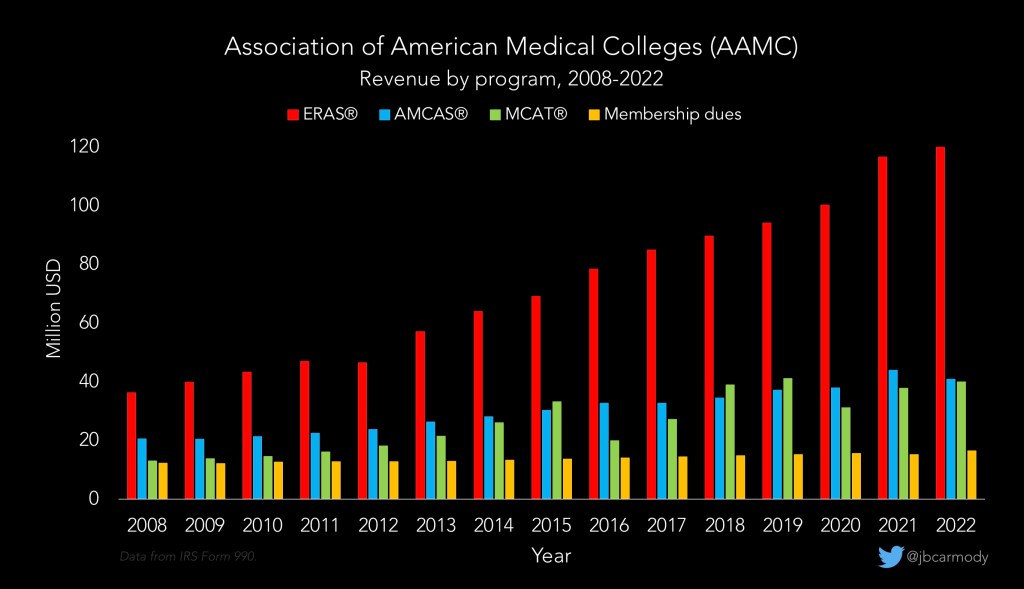

Application Fever fueled a rise in ERAS revenue that would make a venture capitalist jealous. From 2008 to 2022, ERAS revenue nearly quadrupled, from $36 million to $120 million.

ERAS uses a tiered fee structure: ~$10 per application for the first 10 applications, rising to $27 per application for >30. (Because, you know, that’s how computers work). But that means a drop in applications per applicant presents an existential threat to the AAMC (especially at a time when at least one specialty has announced their intent to move to a different software platform).

—

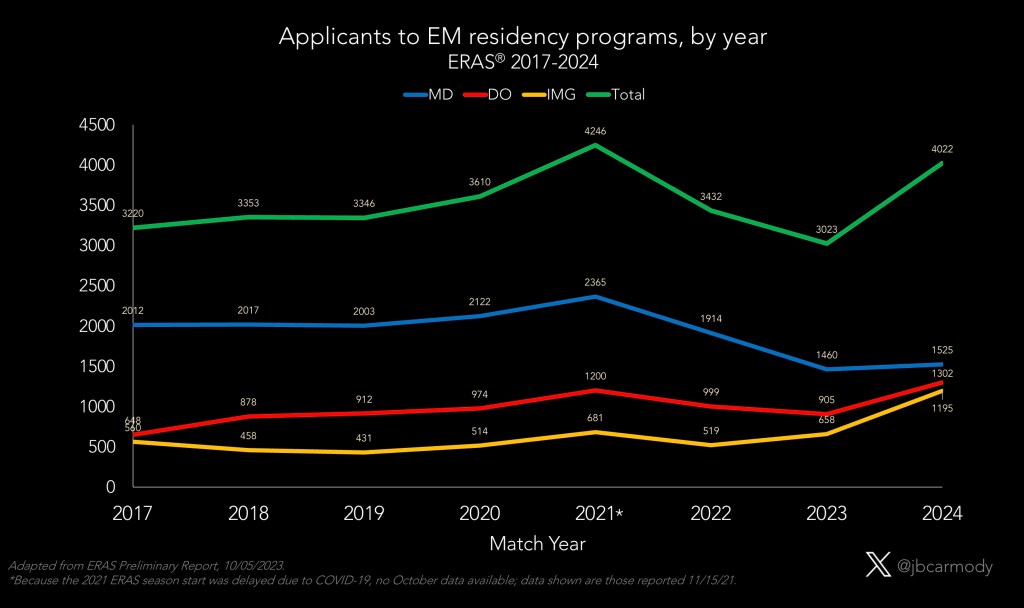

WINNER: Emergency Medicine.

The big story of Match Week 2023 was the shocking number of unfilled emergency medicine positions. (Of course, this news wasn’t shocking to anyone who’d followed the application data: I predicted it in October when the preliminary data showed a continuing decline in EM applicants.)

Would EM rebound in 2024? Early signs point to yes.

Overall applicants to EM are up 33%, and the overall number of October applications at an all-time high.

However, closer inspection of the applicant pool shows that >90% of the increased applicants are from DOs and IMGs. The number of U.S. MDs applying to EM is up slightly – but still 25% lower than pre-pandemic.

What that means is that EM program directors who don’t want to SOAP need to re-evaluate their ERAS filters. Last year’s SOAP crisis caught many programs off guard…. but if powerhouse EM programs go unfilled this year, it’s because they aren’t taking their DO and IMG applicants seriously.

–

LOSER: Pediatrics

In my wrap-up of the 2023 Match, I predicted that the moral panic over unfilled residency positions that hit EM last year would soon spread to pediatrics. There’s nothing in the preliminary ERAS data to sway me from that prediction.

The graphic above shows the distribution of matched applicants in pediatrics over the past 20 years. There are three important trends:

- The number of categorical pediatric residency positions has risen steadily each year.

- Interest in pediatrics among U.S. MD students is declining. (Look how the blue bars drop after 2015.)

- So far, trend #2 has been offset by an increasing number of DO – and to a lesser extent, IMG – applicants. (Note the widening of the yellow and especially the red bars).

Unfortunately for programs, trend #3 has now reversed.

Last year, there were 30 pediatric programs (with 86 total positions) that went unfilled in the Match. Although the overall application numbers aren’t down quite as much as I’d feared, I think we’ve still crossed an inflection point. My guess? I think we’ll see 50+ pediatric programs recruiting for 200+ unfilled positions in this year’s SOAP.

–

LOSER: Family Medicine.

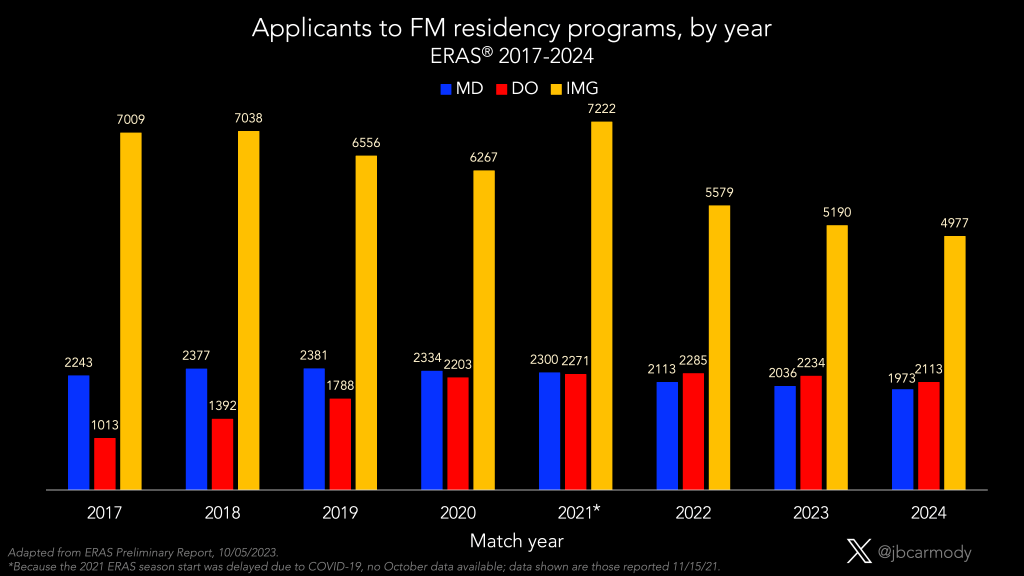

Last year, the only specialty with more unfilled positions than EM was family medicine (577 vs. 554). But just like pediatrics, FM programs face declining interest, not just from U.S. MDs, but now from DO and IMG applicants as well.

Keen-eyed observers may note that, even with the decline, there are still >9000 family medicine applicants this year – which is nearly double the number of family medicine positions offered in the Match (5088 last year). So why are so many family medicine positions going unfilled?

The answer highlights one of the most difficult challenges that family medicine residency program directors are up against – which is that many applicants who apply to FM programs do so as a backup to a more preferred specialty.

(Last year, I talked to a FM PD who rolled out the red carpet, interviewed over 100 applicants – and still filled only half of his program positions. Some of the applicants he thought he was going to get went to other FM programs… but many matched in other specialties altogether. At the time, he told me he was contemplating not interviewing any applicants for the 2023-2024 cycle, and instead just filling the whole class in the SOAP – and it’s easy to see why.)

–

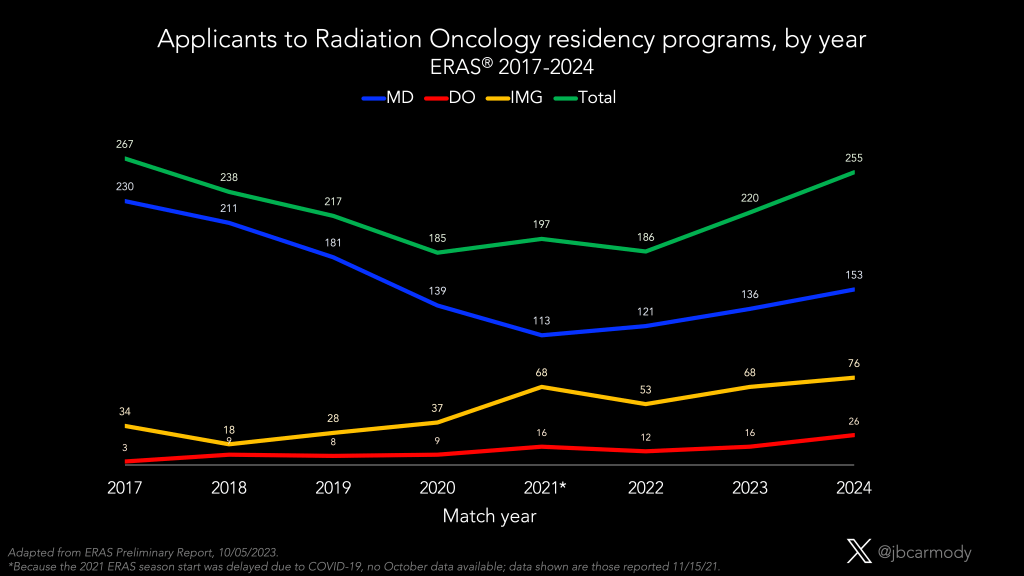

WINNER: Radiation oncology.

Another specialty with a big presence in the SOAP in recent years seems to be recovering. Applicants to radiation oncology programs are up 16% from last year – more than any specialty except EM – with growth in applicants of all educational backgrounds (MD, DO, IMG).

I’ll make the bold prediction that there will be fewer than 15 radiation oncology positions in the SOAP this year. This will still be a disappointing result for those who remember the ultra-competitive radiation oncology matches of 15-20 years ago, but nonetheless demonstrates a major shift from the 2021 Match, when 33% of radiation oncology programs were in the SOAP.

–

LOSER: Dermatology and surgical subspecialty applicants.

The preliminary data show steady increases in applicants to most of the already-hottest specialties. Neurosurgery applicants are up 11% from last year; dermatology is up 10%; otolaryngology, 7%; and orthopedic surgery, 5%. And it’s not like those specialties were easy matches last year.

–

(Graphic from AAMC; they’re the ones who don’t know where Houston is, not me.)

LOSER: U.S. MD schools.

One perplexing trend in recent residency application cycles has been a decline in the number of U.S. MD seniors participating in the Match.

For many years, as new schools opened and class sizes expanded, the number of graduating MD students grew steadily. But last year, the number of MD applicants in ERAS dropped by almost 500. I didn’t quite know how to explain that… but I figured it was a blip that would reverse this year.

It didn’t. Applications are down again – albeit slightly – this year, too. (For comparison, the number of DO applicants increased by ~500 students.)

Where did the applicants go? Is it because more MD students are doing research years to improve their odds of matching in uber-competitive specialties? Is it increased attrition, or decreased enrollment yield due to COVID-19? A rise in students choosing not to do clinical medicine at all?

I’m honestly not sure – but most of the hypotheses I can generate suggest that MD schools may not be fulfilling their social missions of producing doctors to participate in patient care.

–

WINNER: Thalamus.

A few years ago, I thought Thalamus – a Silicon Valley startup founded by a former resident – was going to be the disruptive innovator that would upend the AAMC’s near monopoly on the residency application market.

Their interview scheduling software was better than ERAS’s Interview Explorer – so I figured once they acquired enough market share (or startup capital), Thalamus would pivot into application software and challenge ERAS directly.

So I was as surprised as anyone when the AAMC announced a strategic collaboration in which they agreed to provide Thalamus’ interview scheduling software to ERAS users free of charge. It seemed like Darth Vader contracting with the Rebel Alliance to fix the Death Star’s exhaust port.

Of course, not long after the AAMC-Thalamus venture was announced, OB-GYN programs announced their plan to leave ERAS for the 2024-2025 application season. So did Thalamus bet on the wrong horse?

I don’t think so.

Even if ERAS blows up over the next few years, Thalamus will benefit from ERAS expanding their market share… and sharing their data.

The AAMC’s privacy policy outlines the restrictions on the use of ERAS data – but includes a carve-out for Thalamus:

As part of its collaboration with Thalamus, starting with ERAS application cycle 2024 and subject to appropriate restrictions on use and handling of the data, the AAMC provides ERAS applicant data to Thalamus for Thalamus operations, research (including research by Thalamus.org), and product development.

This is especially important given the trends in residency application highlighted above.

Remember what I said before? About how Big Signaling may put an end to Application Fever… but will replace it with a new, high-stakes competition over which programs to signal?

We live in a world in which the process of applying for residency jobs has been lucratively commoditized – and mark my words, the next frontier will be selling analytics to applicants to help them determine where to signal/apply, and to programs to help them focus their recruiting efforts on applicants who are likely to attend. With the data they’ll harvest from ERAS, Thalamus will be well-positioned to offer these services in the future. (Just remember, you heard it here first.)

–

YOU MIGHT ALSO LIKE:

The Applicant’s Guide to Strategic Preference Signaling